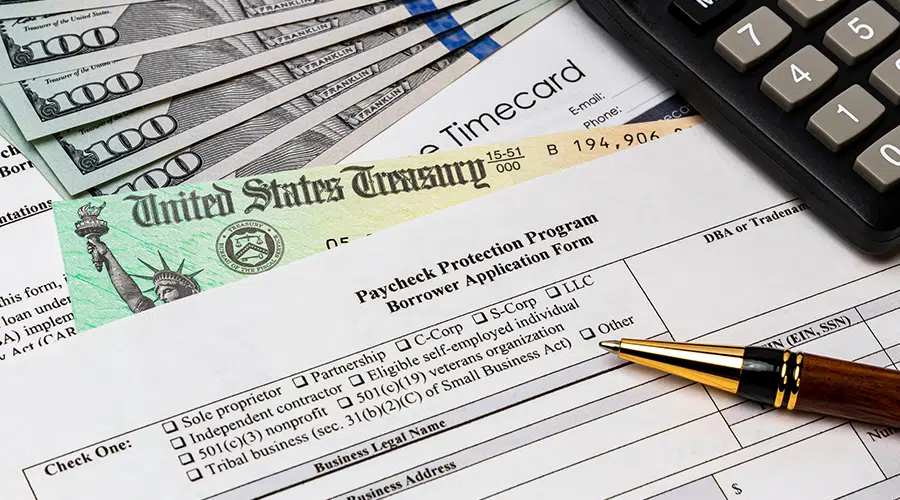

The wildly popular Paycheck Protection Program (PPP) may have ended in May, 2021, but the fall-out from its quick implementation and lack of stringent oversight is just beginning to be played out in federal courts across the country. To date, the PPP and Economic Injury Disaster Loan (EIDL) programs have spawned federal criminal charges against more than 200 individuals for fraud related to the loans, and this is just the beginning. More than 30 federal, state and local law enforcement and other agencies are currently investigating PPP fraud, and the Department of Justice is intensifying its investigation and prosecution of these cases.

If the possibility of a PPP loan fraud investigation has you worried, it is important to get help now from a qualified federal defense attorney. In this blog post, I’ll explain why it is crucial to act now.

The Federal Government Is Relentlessly Pursuing Individuals Suspected of Committing PPP Loan Fraud

While the program was still active, federal watchdog agencies received over 100,000 complaints about potential PPP fraud, and financial institutions filed more than 40,000 reports on suspicious activity with the Department of the Treasury’s Financial Crimes Enforcement Network. The scope of the problem was well documented, as was the government’s lack of resources for following up on and investigating all of the suspected cases of PPP fraud.

This situation changed when the American Rescue Plan became law (March 11, 2021). The Plan specifically provides funding to combat fraud, with approximately $150 million distributed to oversight and enforcement agencies to target fraud in pandemic-related programs. The Pandemic Response Accountability Committee (PRAC), composed of 22 Inspector Generals, now partners with law enforcement agencies to detect and combat fraud, waste, abuse, and mismanagement in these programs. The PRAC coordinates oversight, conducts data analyses, and promotes transparent reporting, detecting and investigation of pandemic-related fraud cases.

In addition to this coordinated, comprehensive approach to oversight, the government’s capacity to investigate and prosecute PPP fraud cases has been increased by additional DOJ personnel devoted to investigating and prosecuting cases and improved government coordination. At least 32 federal, state, and local law enforcement and other agencies are currently investigating PPP and EIDL fraud, and a federal Covid-19 Fraud Enforcement Task Force has been developed to bolster investigative efforts and help promote an organized approach to handling cases with potentially overlapping jurisdiction.

In this environment of intense detection, investigation and prosecution, it is important for individuals who might be suspected of PPP loan fraud to seek advice from an experienced federal defense attorney. An experienced attorney can help prevent additional allegations and mitigate the dire consequences of a federal conviction, as explained in the following sections of this blog post.

A Federal PPP Loan Fraud Attorney Can Help You Avoid Problems During an Investigation

Investigations and audits conducted by federal agencies can have serious consequences, so if you are the target of an investigation or think you could be targeted, being informed about the process and prepared to handle it effectively is important. Working with an experienced federal PPP loan fraud attorney can help you avoid saying or doing something that could incriminate you and lead to additional federal charges.

During a federal investigation, you have the right to remain silent and the right to be represented by legal counsel. Your attorney can best protect your rights by responding to investigators’ questions and requests for information on your behalf. In this way, you can avoid making incriminating statements and possibly being charged with obstructing justice. Your attorney can also advocate for you with federal agents and prosecutors to mitigate the potential negative consequences of federal fraud charges and achieve the best possible outcome for you.

A PPP Loan Fraud Attorney Can Help Mitigate Negative Consequences of Federal Fraud Charges

If you are the target of a PPP loan fraud investigation, you could be charged with any number of serious federal financial crimes, such as bank fraud, wire fraud, money laundering, disaster-relief fraud and government procurement fraud. If convicted of these charges, you could face harsh penalties, such as prison time and large fines. A money laundering conviction, for example, carries a maximum penalty of five years in prison and a $250,000 fine, while a bank fraud conviction carries a maximum penalty of 30 years in prison and a $1 million fine.

With an experienced PPP loan fraud attorney helping you during an investigation, you will be well prepared to mount a strong defense against fraud charges. An experienced federal defense attorney understands how the federal system works and can navigate it effectively to best protect your rights and defend you.

Get the Help You Need from an Experienced Federal Defense Lawyer in Orlando

If you are being investigated for or charged with an offense related to PPP loan fraud, Attorney Jonathan Rose is well prepared to fight to protect your rights, your freedom and your future. Call 407-392-9103 or submit the form on our website to get the legal help you need.